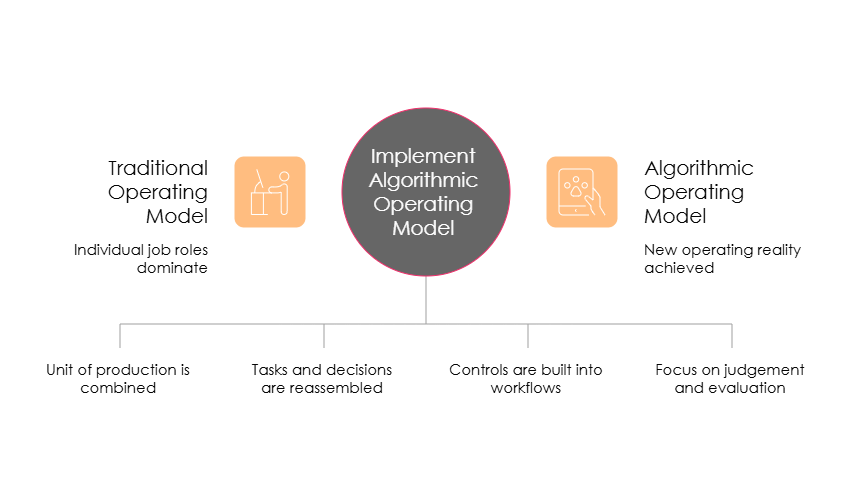

Financial services has always been numbers driven, yet the real disruption today is not about systems, it is about people. Banking, asset management and insurance are being rewired by digital technology, demographic shifts and regulatory pressure. The result is an algorithmic workforce, where human talent and intelligent systems operate side by side and every role is being redefined.

In this landscape, static job descriptions and linear careers no longer work. Technology is moving from a support function to a strategic partner, with CIO teams designing products, shaping client journeys and modernising infrastructure. At the same time, regulation is tightening and populations are ageing, while millennials and Gen Z demand flexibility, purpose and personalised rewards. HR cannot keep up with old tools. Data, automation and AI are now essential to design benefits, career paths and learning experiences that feel tailored, not generic.

Behind all of this is a cognitive shift. Expertise still matters, but what differentiates people now is adaptability, analytical thinking and ethical judgement. The most valuable professionals are constantly learning, able to connect deep financial knowledge with digital tools and AI. As firms embed algorithms into risk models, fraud detection, credit decisions and client engagement, employees must understand not only how these systems work but when to question them. AI governance, transparency and auditability are no longer niche topics, they are core skills.

This is where the distinction between upskilling and reskilling becomes critical. Upskilling augments existing roles. A compliance officer learns how to review model outputs. A relationship manager uses generative AI and prompt engineering to respond rapidly and consistently. An IT developer moves into cybersecurity by building on current technical foundations. Reskilling, in contrast, is transformative. Data processing staff become analysts or engineers. Customer services pivot into digital product development or marketing. Large institutions are already building structured reskilling tracks in areas such as product management, data analytics and cyber, proving that internal mobility can be cheaper and more sustainable than constant external hiring.

Nowhere is this more visible than in core finance roles. AI automates data gathering and cleanses vast datasets at speed, freeing analysts to act as strategic partners rather than report generators. Quants and risk professionals need stronger coding, statistics and model governance skills, yet also sharper communication. The future analyst is a translator, fluent in Python and cash flow modelling, but equally comfortable explaining complex scenarios and trade offs to senior leaders and clients.

Digital skills sit under everything. Cloud, data, cybersecurity and AI literacy are the new baseline. Commercial teams must also evolve. With clients able to access basic information themselves, salespeople win by acting as trusted advisers, combining data insights from customer platforms with human curiosity and empathy. They must interpret algorithmic recommendations, challenge them where needed and co create solutions with clients.

Finally, leadership becomes the decisive force in whether this transformation sticks. Leaders need emotional intelligence, virtual team capability and a clear narrative about how AI augments rather than replaces people. They must sponsor reskilling, listen to employee sentiment through data and design change journeys that feel human, not mechanical.

The algorithmic workforce is not about humans versus machines. It is about building organisations where technology amplifies human judgement, creativity and care. Firms that invest in both technical depth and high order soft skills will be the ones that turn disruption into durable advantage.

Hector Payne

Chief Learning Officer