An Alpha Development and XD Academy paper by John Okoro

A downloadable pdf version of this paper is available here.

Decentralised finance (DeFi) is a rapidly evolving ecosystem that is changing the way we think about financial transactions and services. While DeFi has the potential to democratise finance and increase financial inclusion, there are several knowledge gaps that are hindering its growth and development. As DeFi continues to gain popularity, it is important to bridge these knowledge gaps through learning and development initiatives that will empower individuals and organisations to effectively navigate this complex ecosystem.

In this article, we will explore use cases and issues and the importance of closing DeFi knowledge gaps, and how learning and development can be leveraged to achieve this goal. We will also discuss some of the key areas where knowledge gaps currently exist and how targeted learning initiatives can help address them.

Decentralised Finance is a global, open alternative to every financial service in use today. As a banker do you feel empowered or threatened?

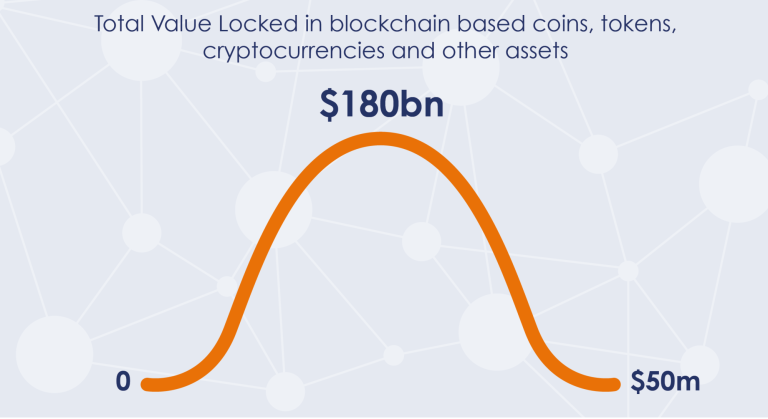

Total Value Locked in blockchain based coins, tokens, cryptocurrencies, and other assets has fluctuated from zero to a peak of around $180bn and down to around US$50m. Is this an indication of a maturing marketplace or the bursting of an asset bubble? Bankers are deciding how to give their clients exposure to these assets, be it through structured products for their High-Net-Worth Individual (HNWI) clients or through derivative products to asset managers such as hedge funds. Asset managers are deciding how to engage in the blockchain space while navigating the swiftly changing regulatory landscape.

The use cases

Blockchain networks can support thousands of decentralised applications, digital money, and global payments. These networks operate in communities and are building a booming digital economy based on peer-to-peer payments that does not require the intermediation of banks. For example Visa Net, built on the blockchain, is on the way to displacing correspondent banking. Should this worry banks or are they already sufficiently engaged in the space?

Blockchain technology is rapidly evolving, and is the place where finance and technology meet. Another use case that is becoming an increasing focus to central banks is the central bank digital currencies (CBDC’s). These digital assets have the potential to change the way that banks and financial services engage with consumers. CBDC’s are new and noteworthy and a blockchain use case that banks should certainly be aware of and educating their staff members on as well.

Security and failures

In the built infrastructure supporting crypto assets there are providers of centralised exchanges (Coinbase, Binance, Gemini and FTX – now defunct), and there are decentralised protocols such as SushiSwap, ShibaSwap and PancakeSwap. The centralised venues have so far escaped the tight regulation that centralised venues in traditional asset classes contend with (such as stock exchanges and futures exchanges). Maybe for this reason there have been some spectacular failures. But these do not detract from the principal of decentralised finance being secured by cryptography, open to anyone with no centralised control that can be a single point of failure. No truly decentralised infrastructure has been subject to failure – rather, it is the access points via centralised finance exchanges that have had failures.

It is expected that regulations will become increasingly clear in nations with developed financial systems and markets. As this happens this will open the door for further engagement by banks and financial services companies. It is key for banks and their staff members to be well versed and prepared to engage in the decentralised finance space even as regulations are being firmed up and finalised in markets like the US, UK, Singapore, Hong Kong, Australia, the EU, and Canada. This will allow banks to be poised to quickly seize opportunities in the potentially very lucrative decentralised finance space.

Energy expenditure

Bitcoin (BTC) mining consumes around 100 Terawatt hours per year (TWh/yr), and this is a major hindrance to supporters of sustainable finance. BTC uses a Proof of Work (PoW) concept, however this is not common across all coin mining. For example, Ethereum uses 0.0026 TWh/yr as it is mined on a Proof of Stake concept.

Although Bitcoin does consume energy to secure its blockchain using PoW mining, the total energy usage represents only 0.16% (247 TWh) of global energy usage – (Source: BP Statistical Review of World Energy Usage 2021). The energy used in PoW mining gives a form of value (in the energy used) to the Bitcoin it produces. There are also Bitcoin mining companies today that fully focus on environmentally conscious mining for example, renewables and excess energy usage.

The nudge and the gap

Banks are starting to face the fact that providing infrastructure (such as payments and correspondent banking), less than secure protocols (such as documentary letters of credit) and loan intermediation may well be supplanted by DeFi in the very near future. Disintermediation is a very real possibility. That is why bankers feel threatened. That is the nudge. That is also why they are moving into the DeFi space to empower themselves. As incumbent banks have established a position of trust with their customers. The areas where they have an advantage is customer connection, trusted advisor, and provider of capital. This is the gap. Banks can fail to heed the nudge and become laggards. If banks fail to move into this gap, and engage in the DeFi space, DeFi will continue to move into the gap.

Empowering L&D – Making the right connections

Learning and development can be empowered to navigate DeFi by following these steps:

- Before delving into the specifics of DeFi, it is important to gain a foundational understanding of what it is and how it works. This includes understanding the underlying technologies such as blockchain, smart contracts, and decentralised exchanges (DEXs), as well as the various DeFi applications and protocols that exist.

- Keep up-to-date with the latest developments: DeFi is a rapidly evolving space, with new protocols, applications, and trends emerging regularly. To stay current, it is important to keep up to date with the latest developments by following relevant news sources, attending conferences and events, and engaging with the DeFi community on social media.

- DeFi is all about using decentralised applications (dApps) to manage finances, so it is important to learn how to use these applications. This includes learning how to interact with DEXs, lending and borrowing protocols, yield farming platforms, and more.

- While DeFi has the potential to disrupt traditional finance and offer many benefits, there are also risks associated with it. It is imperative to understand the risks involved in using DeFi applications and protocols, and to take appropriate precautions.

- It’s important to note that regulations around DeFi are evolving and can change quickly. As a result, it’s essential to stay up to date on the latest regulatory developments in your region.

- Join DeFi communities and networks: DeFi is a highly collaborative space, with many communities and networks that one can join to learn and grow. These communities can provide access to valuable resources, insights, and connections that can help navigate the DeFi landscape more effectively.

Through these steps, L&D will be well positioned to lead in delivering DeFi learning to the key stakeholders in Transaction Banking, Financial Markets, Corporate Banking and Private and Wealth Management. Learning and development can be empowered to navigate DeFi effectively and stay up-to-date with the latest trends and developments in this exciting space.

Contact Alpha Development today. Learn how we can help you prepare your organisation for success in the fast-moving world of Decentralised Finance.

DeFi Learning powered by Alpha Development and XD Academy

Alpha Development and XD Academy have partnered to provide in-depth Crypto and DeFi training courses to Financial Service Institutions. The courses are designed for professionals who want to learn how to develop and leverage blockchain solutions or those who want to explore career opportunities in this exciting new field.

John started his career with Accenture as an executive in the US Financial Services Consulting Practice. Having worked with Fortune 500, Global 1000, start-ups and government clients including Allianz, JP Morgan Chase, Toyota, National University of Singapore, GIC, and ICA in Singapore. John has over thirteen years of expertise in Agile, digital transformation, and related methods, as well as more than five years in the Blockchain space across North American, Asian, and international markets.

John holds a Juris Doctor (J.D.) from Southwestern Law School and Master of Business Administration (MBA) from the University of California (UCLA).

About Alpha

Founded in 2003, Alpha is a specialist Early Careers, Sales, Management & Leadership training provider for blue-chip financial services institutions (incl. the world’s top Investment Banks). Alpha’s USP is its ability to design and deliver complex global training programmes at scale, with insightful content and a partnership approach to driving value for its customers. Alpha specialises in the delivery of complex global financial training programmes, supporting investment banking and asset management L&D departments in both the design and delivery of training.

XD Academy is a decentralised education company offering transformational learning experiences to individuals and businesses clients alike. Founded in 2022 by veterans of both education and crypto, our mission is to unlock the full potential of crypto by making it a safer, simpler, and more accessible opportunity for all.